The luxury segment of the market continued momentum through the third quarter of this year with a nearly 30% increase in the number of luxury transactions. Most notably was the increase in transactions over $7 million, which doubled when compared to this time last year. The luxury segment of the market experienced 9% of the total transactions through the third quarter of 2015.

Record Sale (2015 3Q):

$22,000,000*

Average Sale Price Above $3M:

$5,078,000**

Number of Sales Above $3M:

45

*listing price **not including land sales

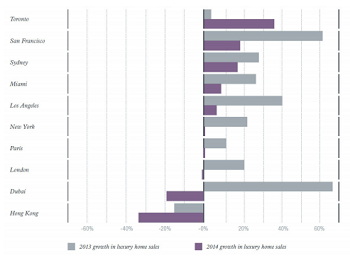

GLOBAL LUXURY REAL ESTATE AT A GLANCE

A Return to Normalcy for Most of the World’s Top Property Markets

As observed in last year’s Luxury Defined report, the world’s top cities experienced an explosion in luxury home sales during 2013, fueled by pent-up demand, increasing consumer confidence, and robust stock market returns. In 2014 however, prime property sales in these markets settled into a stable growth pattern that seems tepid compared to the year prior. (See Exhibit below).

San Francisco, which startled the world with an astronomical 62% increase in $1 million-plus home sales in 2013 compared to 2012, had strong, though less explosive, annual growth of 19% in 2014. “Coming after an exceptional year of strong sales and price appreciation that ranked among the highest in the US, the growth slowdown was predictable, but the positive economic fundamentals of the San Francisco market remain unmatched,” notes Mark McLaughlin of Pacific Union International.

San Francisco, which startled the world with an astronomical 62% increase in $1 million-plus home sales in 2013 compared to 2012, had strong, though less explosive, annual growth of 19% in 2014. “Coming after an exceptional year of strong sales and price appreciation that ranked among the highest in the US, the growth slowdown was predictable, but the positive economic fundamentals of the San Francisco market remain unmatched,” notes Mark McLaughlin of Pacific Union International.

In Miami, the sales pace slowed from 27% growth in 2013 to 9% in 2014. “The single-digit increases of 2014, in contrast to the double-digit increases of 2012 and 2013, reflect a return to more normal market conditions,” says Ron Shuffield of EWM Realty International, whose firm sells a $1 million-plus home in Miami every 17 hours. Across the Christie’s International Real Estate Affiliate network, brokerages reported real estate sales of more than $300 million per day in 2014 ($13 million every hour). Contact me for the full report from the 2015 Global Luxury Real Estate White Paper.

Transactions 34

Transactions 34

San Francisco, which startled the world with an astronomical 62% increase in $1 million-plus home sales in 2013 compared to 2012, had strong, though less explosive, annual growth of 19% in 2014. “Coming after an exceptional year of strong sales and price appreciation that ranked among the highest in the US, the growth slowdown was predictable, but the positive economic fundamentals of the San Francisco market remain unmatched,” notes Mark McLaughlin of Pacific Union International.

San Francisco, which startled the world with an astronomical 62% increase in $1 million-plus home sales in 2013 compared to 2012, had strong, though less explosive, annual growth of 19% in 2014. “Coming after an exceptional year of strong sales and price appreciation that ranked among the highest in the US, the growth slowdown was predictable, but the positive economic fundamentals of the San Francisco market remain unmatched,” notes Mark McLaughlin of Pacific Union International.