Jackson Hole 2015 Mid-Year Market Overview

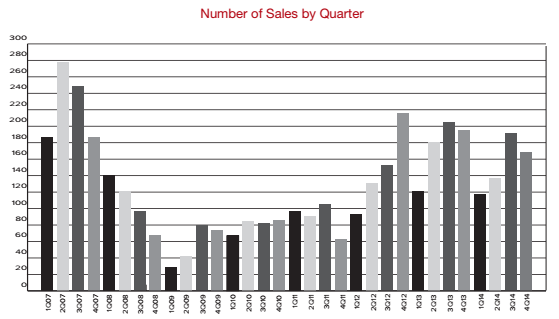

On behalf of our team of dedicated professionals at Jackson Hole Real Estate Associates, we are pleased to present the 2015 mid-year comprehensive market report for the Jackson Hole area. The Jackson Hole real estate market continues with vigorous momentum.

Summertime in Jackson Hole brings a plethora of new inventory to the market and despite this growth, supply is still not able to keep up with demand, and the shortage of inventory continues. With inventory levels very low and notable price increases in all segments, the market appears to be robustly positioned for continued growth.

Overall Market

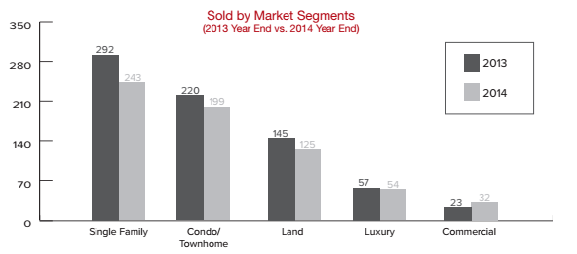

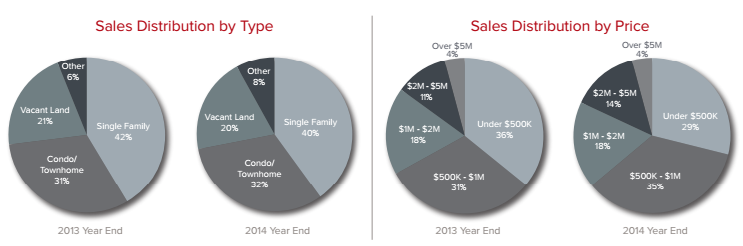

The number of transactions, when compared to the first half of 2014, increased more than 20%, with more than 300 transactions so far this year. Both the average and median sale price increased a notable amount, up 26% and 22% respectively. The upward trajectory in sale price coupled with more transactions has caused a significant increase in the total dollar volume, which is up nearly 47% from this time last year. Another factor in the amplified total dollar volume was a shift in the price segment of transactions. For example, there were 12% fewer transactions under $500,000 and 160% more transactions over $5 million. In fact, the $1 million-$2 million segment had approximately 63% more transactions and the $2 million-$5 million segment had over 30% more transactions.

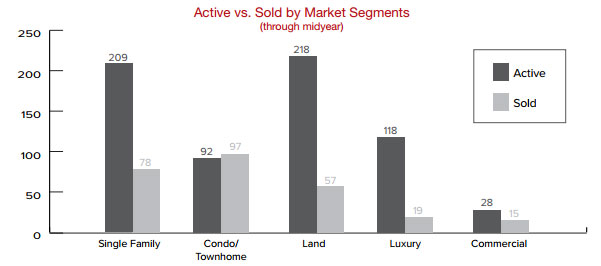

As of 2015 mid-year, there were 537 active listings on the market, an approximate 12% decrease when compared to 2014 mid-year.

MARKET OVERVIEW BY SEGMENT

Single Family Segment

The single family segment of the market had noticeable increases in the first half of 2015. The number of transactions increased over 35% with 106 sales. The average sale price of a single family home in the valley was approximately $1,888,000, more than a 20% increase from 2014 mid-year. Similar to the overall market, the single family segment experienced a powerful increase in total dollar volume, up 58% when compared to this time last year. This increase can be explained by a combination of rising sale prices and quantity of transactions, as well as a shift in the price segment in which most transactions occurred. There was only one single family home transaction for less than $500,000 (an 80% decrease) at mid-year, while the $1 million-$2 million segment had 57% more transactions and the over $5 million segment had 150% more transactions. The two areas with the most single family home transactions were the Town of Jackson and the area just south of Jackson, each representing over 25% of the total quantity of single family home transactions. The shortage of inventory in the single family segment of the market was not as pronounced as in other segments, but at mid-year, the number of single family homes on the market was down 4% compared to last year.

Condominium & Townhome Segment

The condominium/townhome segment of the market experienced another strong quarter with transactions up 12%. Similar to the single family segment, the price level distribution shifted dramatically. This shift greatly increased the average sale price (a 53% increase) as well as the total dollar volume (a 57% increase) when compared to the first half of 2014. Condominiums/ townhomes in the over $1 million segment captured 25% of the transactions in the first half of 2015. This same over $1 million segment comprised 10% of the transactions this time last year. Most notable was the $2 million-$3 million segment, which included 9 transactions. The hotspot for condominium/townhome sales was Teton Village, which experienced an approximate 88% increase in transactions and nearly 30% of the total condominium/townhome market. The inventory shortage has been most pronounced in the condominium/townhome segment, and inventory has continued to decrease – down 14% when compared to this time last year.

Vacant Land Segment

The vacant land segment largely recuperated from the economic downturn and showed solid gains in the first half of 2015, with transactions up 18%. As with all other segments of the market, the vacant land segment experienced an upward shift in price level distribution, which pushed the average sale price up 15%, and the total dollar volume up nearly 48%. The number of vacant land transactions under $500,000 dropped 20% while the number of transactions over $1 million increased over 40%. In fact, there were 3 sales in the over $5 million segment. Teton Village experienced the majority of land sales spurred by the popularity of the Shooting Star development. The active inventory for vacant land decreased 15% when compared to the same time last year, and there is currently about 16 months’ worth of inventory on the market.

The condominium and townhouse segment of the market is still going strong and has not shown any signs of a slowdown. The number of transactions so far this year is on par with the first half of 2013, however, the total dollar volume increased nearly 10%. This can be attributed to the evident appreciation in this segment of the market. In particular, the median sales price increased over 25% to $487,500 when compared to the first half of 2013. This segment of the market has continued its growth at such a strong rate, in part due to the affordability. This is still the one piece of the Jackson Hole real estate market where a buyer can purchase under the $500,000 mark. Nearly 45% of the sales so far this year have been under $500,000, however, sales in this price range are most definitely diminishing. In fact, compared to the same time period last year, there were about 27% less sales under $500,000. When looking at the sales in the Town of Jackson (which is where the majority of condos and townhomes exist), the average sale price increased nearly 20%. Condos and townhomes continue to be in short supply, with only 85 units currently available and another 24 units under contract. This represents less than a 6 month supply.

The condominium and townhouse segment of the market is still going strong and has not shown any signs of a slowdown. The number of transactions so far this year is on par with the first half of 2013, however, the total dollar volume increased nearly 10%. This can be attributed to the evident appreciation in this segment of the market. In particular, the median sales price increased over 25% to $487,500 when compared to the first half of 2013. This segment of the market has continued its growth at such a strong rate, in part due to the affordability. This is still the one piece of the Jackson Hole real estate market where a buyer can purchase under the $500,000 mark. Nearly 45% of the sales so far this year have been under $500,000, however, sales in this price range are most definitely diminishing. In fact, compared to the same time period last year, there were about 27% less sales under $500,000. When looking at the sales in the Town of Jackson (which is where the majority of condos and townhomes exist), the average sale price increased nearly 20%. Condos and townhomes continue to be in short supply, with only 85 units currently available and another 24 units under contract. This represents less than a 6 month supply. Jackson Hole, Wyoming is synonymous with luxury and is an international marketplace for luxury real estate. The demand for high quality, exclusive properties the first half of 2014 did not disappoint. The number of luxury transactions remained steady when compared to the first half of 2013. The first half of this year brought 19 residential and land sales over $3 million. The Teton Village area made up the majority of the luxury sales, followed closely by the area just south of Jackson which includes 3 Creek Ranch, a private golf community.

Jackson Hole, Wyoming is synonymous with luxury and is an international marketplace for luxury real estate. The demand for high quality, exclusive properties the first half of 2014 did not disappoint. The number of luxury transactions remained steady when compared to the first half of 2013. The first half of this year brought 19 residential and land sales over $3 million. The Teton Village area made up the majority of the luxury sales, followed closely by the area just south of Jackson which includes 3 Creek Ranch, a private golf community.

Last week I attended a conference in NYC as one of JHREA’s representatives for Christie’s International Real Estate. The educational and networking meeting included an attendance of almost 400 brokers from 13 states and seven countries at Rockefeller Center.

Last week I attended a conference in NYC as one of JHREA’s representatives for Christie’s International Real Estate. The educational and networking meeting included an attendance of almost 400 brokers from 13 states and seven countries at Rockefeller Center.