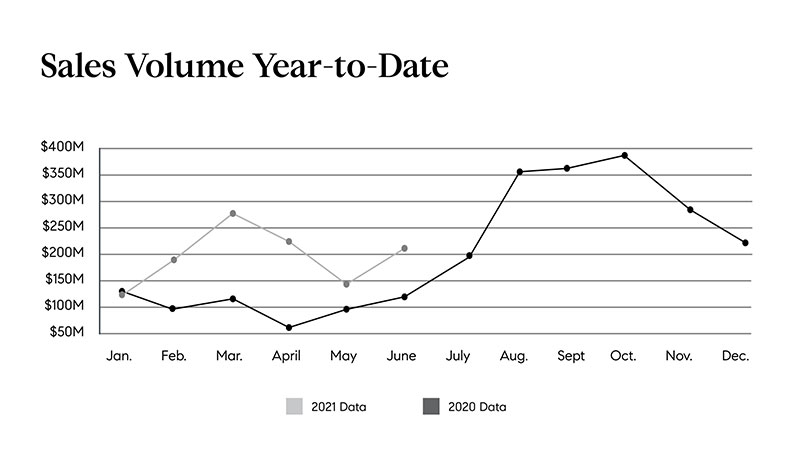

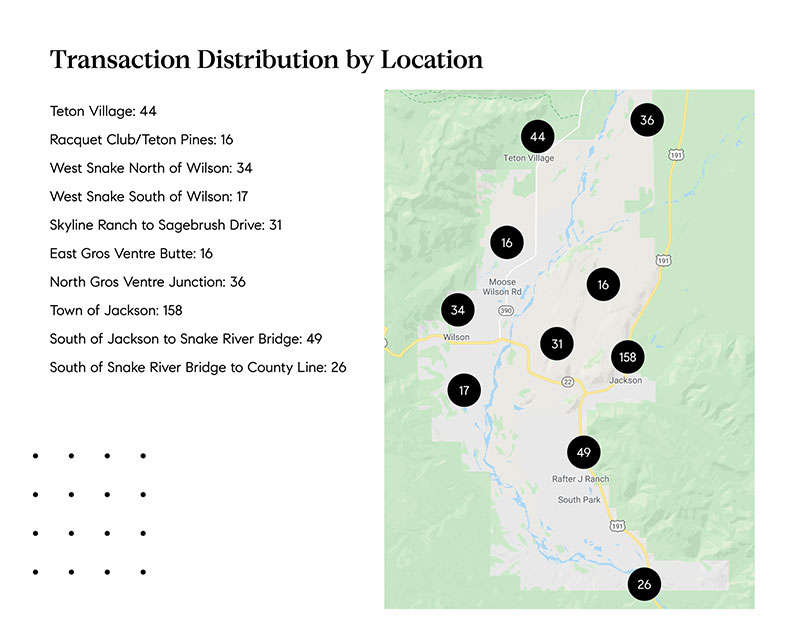

I am pleased to present our comprehensive market report for first quarter of 2021. After a record breaking 2020, the Jackson Hole real estate market continues to break records for the first quarter of 2021. The number of transactions in Teton County spiked up 66% and total sales volume rose an incredible 77% when comparing Q1 2021 to Q1 2020. The attributes Teton County offers: wide-open spaces, wildlife, scenery, recreation, safety, ease of travel and tax benefits, seem to be more desirable than ever.

As in the early summer of last year, Jackson Hole is still experiencing an exodus of individuals from cities in seek of a less-urban lifestyle, pushing demand for local real estate to new heights. In addition, sellers who own real estate in the area are taking advantage of this strong market to look for new opportunities.

Notably, increasing sales prices are resulting in more properties entering the Luxury Segment of the market (listings at the $3M mark and higher). This category dominated in the first quarter, with transaction volume up an incredible 80% and sales volume up 77%. Conversely, in the entry-level end of the market, Q1 reported only 6 sales under the $500K mark as inventory under $1M becomes difficult to find.

Overall, in Teton County, active listings at the time of this report are down 76% creating a dearth of inventory. Pending listings are up 130%, confirming the intense demand. Days-on-market are down and although a small amount of inventory lingers on the market, as new inventory hits, multiple offers within hours are becoming the new norm.

With the dramatic increase in transactions, the overall average sales price for Single Family Homes grew 10% to $4.3M with the median sales price at $2.9M, up 40%. Even with historically low interest rates, more buyers are paying cash in this competitive market with conventional financing down 23% Q1 2021 vs. 2020.

In this market, it is more important than ever to work with the #1 brokerage in the region in real estate transactions. I monitor real estate daily keeping our seller and buyer clients up to date with quickly changing information.

For more information, or to learn more about specific market details, contact Bomber.